The benefit of a medicare advantage plan is crcr – As the topic of Medicare Advantage plans and their multifaceted benefits takes center stage, we embark on a comprehensive exploration of this transformative healthcare option. This discussion will delve into the intricacies of Medicare Advantage plans, unraveling their advantages, and providing invaluable insights for informed decision-making.

Medicare Advantage plans, also known as Part C, offer a comprehensive range of healthcare benefits, providing enrollees with a more holistic and cost-effective approach to their healthcare needs. These plans are designed to complement the coverage provided by traditional Medicare, offering additional benefits and cost-saving opportunities.

1. Medicare Advantage Plans

Overview

Medicare Advantage plans are private health insurance plans that are approved by Medicare and offer an alternative way to receive Medicare benefits. These plans provide comprehensive coverage that includes all the benefits of Original Medicare, as well as additional benefits such as dental, vision, and hearing coverage.

Types of Medicare Advantage Plans

- Health Maintenance Organizations (HMOs)

- Preferred Provider Organizations (PPOs)

- Private Fee-for-Service (PFFS) plans

- Special Needs Plans (SNPs)

Eligibility Requirements for Medicare Advantage Plans

To be eligible for a Medicare Advantage plan, you must be enrolled in Medicare Part A and Part B. You must also live in the plan’s service area.

2. Benefits of Medicare Advantage Plans

Medicare Advantage plans offer a number of benefits over Original Medicare, including:

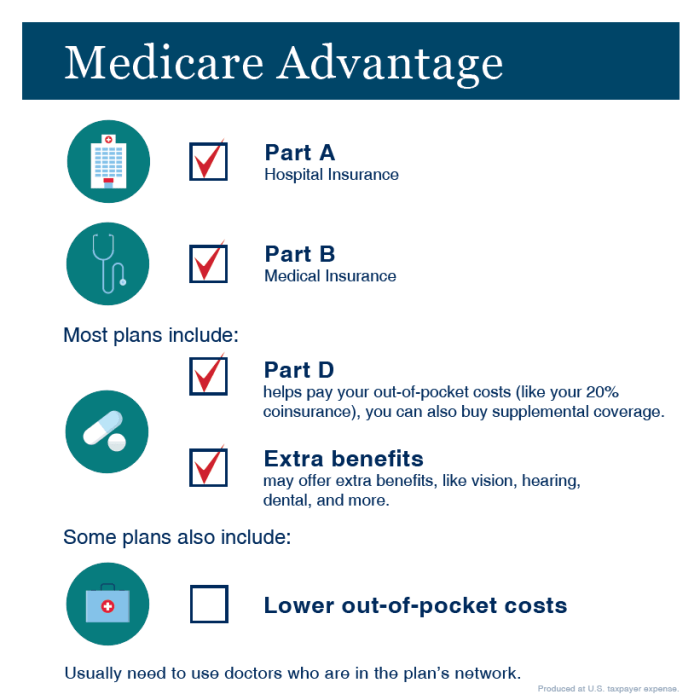

Comprehensive Coverage

Medicare Advantage plans provide comprehensive coverage that includes all the benefits of Original Medicare, such as hospital stays, doctor visits, and prescription drug coverage.

Additional Benefits

Many Medicare Advantage plans offer additional benefits that are not covered by Original Medicare, such as dental, vision, and hearing coverage. These benefits can help you save money on your healthcare costs.

Cost-Saving Opportunities, The benefit of a medicare advantage plan is crcr

Medicare Advantage plans can help you save money on your healthcare costs in a number of ways, such as by offering lower premiums, deductibles, and copays.

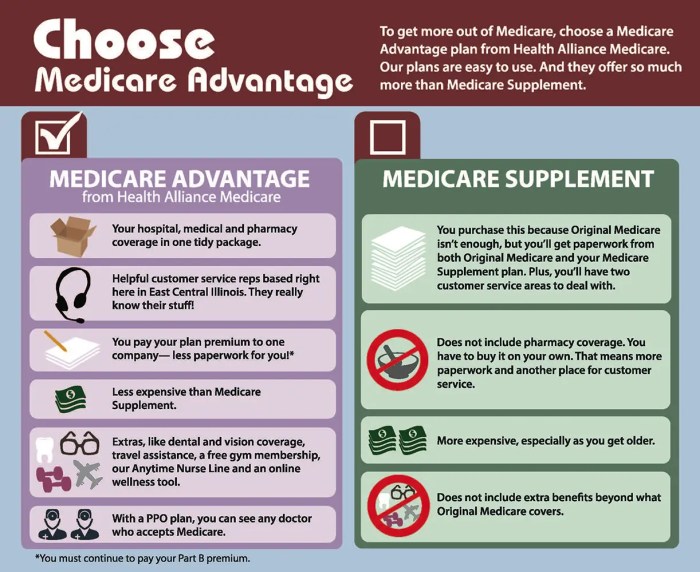

3. Medicare Advantage Plans vs. Traditional Medicare

Medicare Advantage plans and traditional Medicare are both ways to receive Medicare benefits. However, there are some key differences between the two options.

Benefits and Coverage

Medicare Advantage plans offer more comprehensive coverage than traditional Medicare. In addition to the benefits of Original Medicare, Medicare Advantage plans often offer additional benefits such as dental, vision, and hearing coverage.

Costs and Premiums

Medicare Advantage plans typically have lower premiums than traditional Medicare. However, you may have to pay higher deductibles and copays for services.

Advantages and Disadvantages

There are a number of advantages and disadvantages to choosing a Medicare Advantage plan over traditional Medicare. Some of the advantages include:

- More comprehensive coverage

- Lower premiums

- Cost-saving opportunities

Some of the disadvantages include:

- Higher deductibles and copays

- Limited provider networks

- Need for referrals

FAQ Corner: The Benefit Of A Medicare Advantage Plan Is Crcr

What are the eligibility requirements for Medicare Advantage plans?

To be eligible for a Medicare Advantage plan, you must be enrolled in Medicare Part A and Part B, and reside in the plan’s service area.

Do Medicare Advantage plans cover prescription drugs?

Yes, many Medicare Advantage plans include prescription drug coverage. These plans are known as Medicare Advantage Prescription Drug Plans (MA-PDs).

Are there any additional costs associated with Medicare Advantage plans?

Yes, Medicare Advantage plans typically have monthly premiums and may also have deductibles, copays, and coinsurance.

How do I choose the right Medicare Advantage plan for me?

Consider your healthcare needs, budget, and the benefits and costs of different plans. You can compare plans using Medicare’s Plan Finder tool or consult with a licensed insurance agent.