Harry and Helen are married filing jointly, a decision that can significantly impact their tax liability. This comprehensive guide delves into the benefits, eligibility requirements, and tax implications of joint filing for married couples, empowering them to make informed decisions and optimize their tax savings.

Joint filing offers numerous advantages, including access to higher standard deductions, reduced tax rates, and the ability to combine income and deductions to minimize taxable income. However, it is crucial to understand the eligibility criteria and potential drawbacks to ensure that joint filing is the most advantageous option for each couple.

Joint Tax Filing

Filing taxes jointly as a married couple offers several advantages, including the potential for increased tax savings and access to certain deductions and credits that are not available to individuals filing separately.

To be eligible for joint filing, couples must meet the following requirements:

- Both spouses must be U.S. citizens or residents.

- Both spouses must file their taxes using the same filing status (married filing jointly).

- Couples must be legally married as of the last day of the tax year.

Some of the tax savings and deductions available to married couples who file jointly include:

- Higher standard deduction:Married couples filing jointly have a higher standard deduction than individuals filing separately, which can reduce their taxable income.

- Increased child tax credit:The child tax credit is available to both spouses when they file jointly, potentially doubling the amount of the credit.

- Marriage bonus:Married couples may qualify for a marriage bonus, which is a tax credit that reduces their overall tax liability.

Tax Implications for Married Couples: Harry And Helen Are Married Filing Jointly

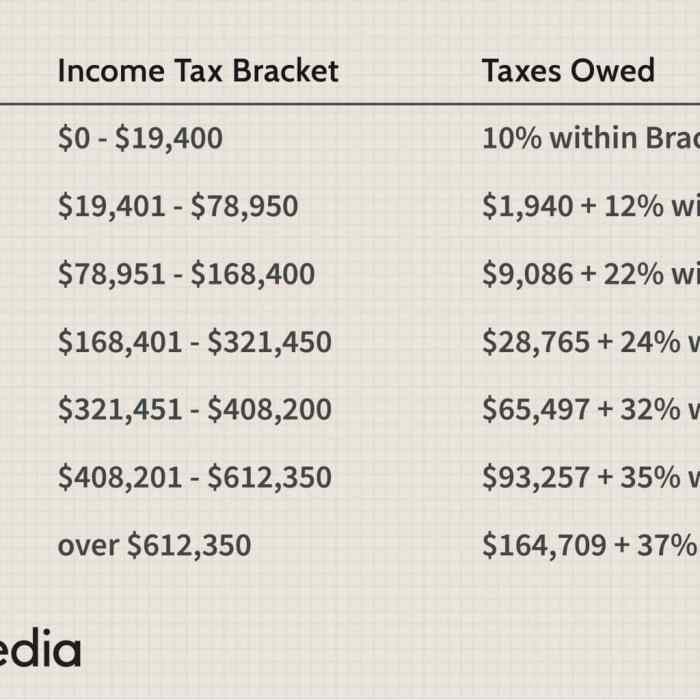

Married couples who file jointly are subject to different tax brackets and rates than individuals filing separately. The tax brackets for married couples filing jointly are generally wider than those for individuals, which means that couples may pay less in taxes at higher income levels.

Filing jointly also impacts standard deductions and personal exemptions. The standard deduction for married couples filing jointly is higher than the standard deduction for individuals, while the personal exemption is phased out at a higher income level for married couples.

Couples must carefully consider whether to itemize deductions or take the standard deduction when filing jointly. Itemizing deductions can be beneficial if the total amount of itemized deductions exceeds the standard deduction. However, couples should compare the amount of their itemized deductions to the standard deduction to determine which option will result in the lower tax liability.

Income and Deductions

The following table compares the income and deduction limits for married couples filing jointly vs. separately:

| Filing Status | Income Limit for Itemized Deductions | Standard Deduction | Personal Exemption |

|---|---|---|---|

| Married filing jointly | $341,200 | $27,700 | $4,300 |

| Married filing separately | $170,600 | $13,850 | $4,300 |

When filing jointly, couples must combine their income and deductions. This means that their total income is used to determine their tax bracket and the amount of deductions they can claim. Couples should work together to maximize their deductions and minimize their taxable income.

Filing Process and Forms

To file a joint tax return, couples must use Form 1040. They will also need to gather the following documents:

- Social Security numbers for both spouses

- W-2 forms for both spouses

- Other income documents, such as 1099 forms

- Deduction and credit documentation

Couples should carefully review their tax return before filing to ensure that all information is accurate and complete. They can file their return electronically or by mail.

Questions and Answers

Is joint filing always the best option for married couples?

Not necessarily. Joint filing may not be beneficial if one spouse has significantly higher income or deductions than the other, as it could result in higher taxes overall.

What are the eligibility requirements for joint filing?

To file jointly, both spouses must be married and file a joint return. They must also meet the residency and citizenship requirements set by the IRS.

Can we file jointly even if we live in different states?

Yes, as long as you are legally married, you can file a joint return regardless of your state of residence.